When constructing outwards isn’t accessible to you, a next story addition may very well be the best choice for generating more room.

There is a straightforward attractiveness in putting a relatively small- or medium-sized house extension over a bank card. If This is actually the route you choose, make sure you’re on the deal that has a 0% introductory level when you’re getting a whole new credit card for this specific reason. Normally, you might wind up paying many curiosity around the investment.

Our knowledgeable team of skilled architects and designers will help you increase your house up and/or out to satisfy your desire for Room and turn your vision of one or double-storey extension into fact.

A escalating household indicates a rising need to have for House. Whether or not you ought to include an extra bedroom, one-storey extension is the right Resolution.

An extensive information to budgeting, financing, and maximizing the value of your house addition renovation challenge.

Homeowners often take into account borrowing more money on their own home loan to purchase an addition or other home enhancement jobs because of not acquiring the obtainable fairness to employ a home equity loan or line of credit score or to take advantage of reduced fascination fees than private loans.

Once again, this selection ought to be imagined via with care while you’d be escalating the amount of borrowing that’s secured against your home, quite maybe at a fee that’s larger than your existing property finance loan.

They will also want to contemplate how a further loan payment could possibly in good shape into their regular monthly spending plan, selecting a funding choice that will permit them to entry the funds they have to have with no borrowing greater than is critical.

Financing a home addition might be very costly and infrequently needs a considerable injection of money and the reality is always that those which have only just lately purchased their residence and who haven’t nonetheless bought sufficient tappable equity, this isn’t likely to be a choice.

For all loans sanctioned with or devoid of co-applicants, the prepayment cost shall be levied at the speed of 2%, furthermore applicable taxes/statutory levies from the quantities remaining so pay as you go on account of component or comprehensive prepayments other than when component or complete prepayment is currently being manufactured by individual resources*.

Can you receive a decreased fascination price? If that's so, a dollars-out refinance could get monetary savings in your present mortgage and also your home improvement loan simultaneously

Nevertheless, it’s crucial to Take note that a dollars-out refinance will alter far more than simply the loan total. Curiosity fees and various phrases will also be impacted, which means homeowners will need to pay near awareness to the marketplace right before pursuing this financing alternative; or else, they may find on their own with below favorable loan conditions.

Depending on the corporation, the applying process for contractor funding might also be faster plus much more streamlined than for other financing choices, allowing homeowners to break floor on their new task faster as opposed to afterwards.

To determine their DTI, possible borrowers can divide their every month financial debt payments by their overall every month revenue right before taxes. Ultimately, homeowners will need a fantastic or excellent credit score to qualify for ต่อเติมบ้าน ธอส this loan kind, with a lot of lenders demanding a minimal credit rating of 620, even though correct requirements might vary among lenders.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Ralph Macchio Then & Now!

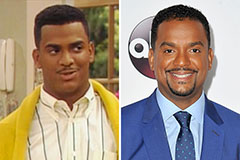

Ralph Macchio Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!